As surprising as it may seem, some employers still fail to pay their employees proper minimum wage and overtime under California law. Recently, the California Department of Industrial Relations issued wage theft citations of roughly $16 million against several California restaurants. The California restaurants were cited for wages, premiums, and penalties owed to hundreds of employees for various wage theft violations. Investigations exposed a heinous amount of wage theft as it was discovered that employees, mostly waiters and waitresses, were paid an average of $1.15 per hour. Some waiters and waitresses were even either not compensated at all or were just paid a fixed rate of $200 per month. Also, kitchen employees were also never compensated for overtime. Considering some employers have trouble following wage and hour laws, let’s go over some of the basics.

As surprising as it may seem, some employers still fail to pay their employees proper minimum wage and overtime under California law. Recently, the California Department of Industrial Relations issued wage theft citations of roughly $16 million against several California restaurants. The California restaurants were cited for wages, premiums, and penalties owed to hundreds of employees for various wage theft violations. Investigations exposed a heinous amount of wage theft as it was discovered that employees, mostly waiters and waitresses, were paid an average of $1.15 per hour. Some waiters and waitresses were even either not compensated at all or were just paid a fixed rate of $200 per month. Also, kitchen employees were also never compensated for overtime. Considering some employers have trouble following wage and hour laws, let’s go over some of the basics.

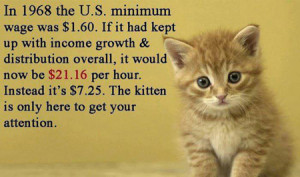

As of July 14, 2014, California’s minimum wage is $9.00 per hour. Although the Federal minimum wage is $7.25 per hour, California law supersedes for employees working in California. Thus, the California restaurants were breaking both California and Federal law by paying their employees only $1.15 per hour. It is also important to note two important things. Employees cannot waive minimum wage so even if some of the waiters and waitress here agreed to be paid under minimum wage, that agreement would not hold water in court. Second, since we are talking about employees who make tips, California law prohibits an employer from crediting tips toward minimum wage and also prohibits an employer from taking any amount of tip given to an employee by a patron.

Under California law, an employer must pay 1 ½ times the employees regular wage after 8 hours worked in a day and after 40 hours worked in a week for all non-exempt employees. Sometimes employers tell an employee that it is necessary for him or her to work long hours due to the nature of the assignment and therefore overtime is not required. Or employers might tell employees that the company he or she works for does not fall under the kind of company that must pay overtime under California law. These are all fabrications and excuses not to pay an employee. All that matters is if the employee worked overtime hours and whether the employee worked with the knowledge of his employer.

Although it sad and unfortunate that employers continue to violate basic wage and hour laws, citations issued by the California Department of Industrial Relations, such as the citation discussed above, shows that employee rights are still being fervently upheld across the state. If you believe your employer is paying you under minimum wage or you are being deprived of overtime, contact an attorney immediately.